Learning management systems are a key component of every corporate L&D roadmap, but contrary to popular opinion, an LMS is not a one-size-fits-all proposition. Depending on your industry, you likely have specific requirements that not every LMS supports, or require additional work to configure. This is especially true in the banking and financial industries where compliance and regulations can be much more rigorous than in other sectors.

So what do you need to consider when choosing an LMS for banking? In this article, we will look at what mandatory features should be on your shopping list for bank e-learning systems and LMSs for financial services. We will then compare six platforms and see how they stack up against the feature list. So, by the end of the article, you’ll have a great foundation to draw from when selecting your LMS.

But first, let’s take a quick side-by-side view of all the LMS solutions I reviewed.

LMSs for Financial Institutions: Quick Comparison Chart

| LMS | Type of solution | Distinctive features |

| 1. iSpring Learn | A cloud-based LMS that focuses on being easy to use even for beginners, while still offering extensive options to author and deliver your training programs. |

|

| 2. eFront | An LMS with powerful customization options, access to source code, and a variety of private cloud or on-premise hosting options. |

|

| 3. Paradiso | A combined LMS that focuses on delivering four pillars – Utility, Price, Maintenance, and Mobile Compatibility. |

|

| 4. Docebo | A customizable LMS with a modular system, offering opportunities for both formal and informal learning and AI support. |

|

| 5. Dokeos | A privacy and compliance LMS that offers out-of-the-box support for regulatory, audit, and compliance requirements. |

|

| 6. Gyrus | An LMS that allows you to manage all of your training, including e-learning and ILT – in classrooms and via webinars, assessments, and certifications. |

|

Mandatory Features for Financial Service Industry LMSs

There are certain LMS features that I would consider non-optional for financial sector use.

- Flexible organizational structure. By this, I mean that it will allow you to mirror your enterprise structure and hierarchy setup. So, whether your organization works with departments and sub-departments, cost center business units, or any other structure, your chosen LMS should be able to cater for this. For example, you can assign a course only to deposit operations managers or to the whole Central Audit & Inspection Department.

- Blended learning. This just means that you have the ability to mix and match content and delivery types within your training programs, for example, an instructor-led module backed up with an online module and exam. Why is this important for banking and financial training? Many financial certification programs stipulate an instructor-led component, but that’s no reason to make the whole course offline.

- Certifications. This is a nice feature for almost all industries, but for finance, it’s a must-have. Being able to not only certify your employees but also to verify their credentials if required by an audit is something every financial business should be concerned about.

- Advanced reporting and analytics. Following on from the last point about certification, it’s crucial for financial businesses to know exactly who has been trained on what and when and what results they achieved. Regulations are constantly changing, and you need to know the version of the regulation or SOP (Standard Operating Procedure) that each employee was trained and assessed in to determine and prove compliance.

- High security. It goes without saying that any LMS being used by financial organizations should have strong platform security that complies with industry regulatory requirements.

I’ve pre-selected six LMS banking platforms that tick all those boxes and should fit your basic needs, so I will focus on the extras, additional options, and USP of each LMS in the following breakdown.

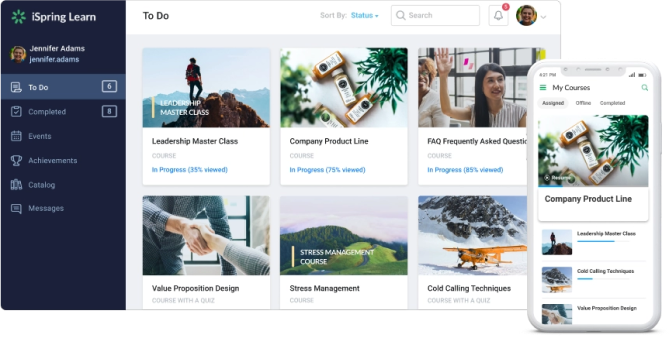

1. iSpring Learn

Try for freeRating: 4.6/5 from 133 reviews (Capterra)

iSpring Learn is a cloud-based LMS with a 30-day free trial that focuses on being easy to use even for beginners, while still offering extensive options to author and deliver your training programs.

Deep dive

iSpring Learn is a user-friendly LMS that aims to take the headaches and tech issues out of corporate learning. To deliver on the promise of simplicity and friendly user experience, it features a simple interface that makes it easy for learners to access, navigate, take courses and assessments, and view their results.

Administrators will find it easy to upload new training content, manage users, and create reports without training. A major plus point of this platform is that it can be administered by almost anyone in your organization, HR professionals, or bank managers.

Some advanced LMS systems now feature their own built-in editors and basic course building tools, and iSpring Learn is no exception – it has an editor to create content with images, quote blocks, video, and quizzes.

This is great for basic courses, but will not always be suitable for complex financial training programs, for example, risk management.

The good news is that this LMS is integrated with the iSpring Suite authoring toolkit. iSpring Suite lets you build interactive courses, including slide-based courses, quizzes, assessments, and dialog simulations. You can also convert existing PowerPoint slides to HTML5 or any eLearning format and enhance them with tests and screencasts.

Once you’ve created a course, it only takes you a couple of clicks to upload it from the authoring toolkit to iSpring Learn. Then you can assign the course to your employees, as well as keep track of your learners’ results.

From the LMS, you can combine your courses with Zoom-integrated video conferencing to build blended learning solutions. Via web meetings, you can keep your staff informed on the latest updates on your financial products and share other important information on services.

If you do run into any issues, iSpring Learn’s award-winning 24/7 technical support is ready to assist. The company claims that 83% of all cases are resolved within 2 hours after requesting support.

Pricing

iSpring offers two types of subscription – Start and Business, with Business coming with more advanced features. The price depends on the subscription you choose and the number of learners who enter the platform during a month. For example, the plan for 100 learners/month (Start subscription) costs $2.87 per learner.

Goodies I found

- Easy to use and navigate

- Built-in basic course builder

- Integrated course authoring tool

- Integration with Zoom web meetings

- 24/7 technical support

My final opinion

iSpring Learn is a great banking LMS solution for institutions looking to effortlessly deliver e-learning and blended compliance training. With the integration of the iSpring Suite authoring tool, it’s also a great option for financial organizations to create and deliver financial product and service training that leverages the in-built dialog simulation tool.

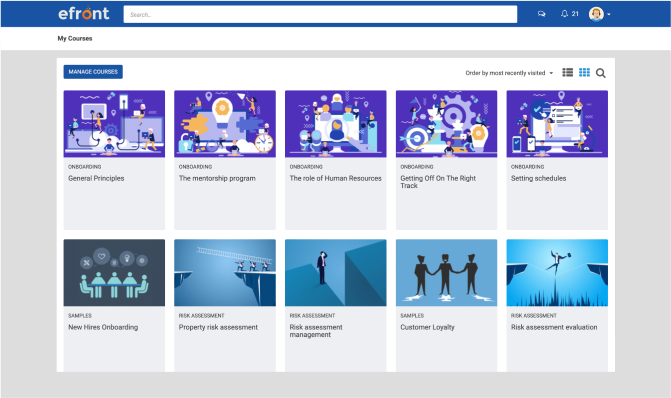

2. eFront

Learn moreRating: 4.6/5 from 35 reviews (Capterra)

eFront LMS is designed to be a learning management system that allows you to build an enterprise training platform exactly as you want it. This means powerful customization options.

Deep dive

The main promise of eFront is to be able to tailor your LMS solution to be exactly what you want it to be. You will have access to the platform source code, and starting right from how you want your LMS to be hosted, you will have a high degree of customizability. Hosting options are aimed at supporting compliance with your country data residency requirements and regulations by hosting your service on AWS infrastructures based in the U.S., EU, Asia, and Australia.

The look, feel, and structure of eFront can all be customized, so you can present a front end to your learners that makes sense for your organization.

eFront is of interest as a banking LMS, particularly due to a high level of security features, filters, and administrative tools. It goes without saying that any LMS featured in this article will have advanced data encryption – eFront extends this to provide a variety of access controls, audit logs, 2FA, and other enterprise-level security features.

You can build courses directly in eFront using a native H5P editor. For those unfamiliar with H5P, it’s an open-source HTML5 standard. I would consider it useful for creating basic courses, but it’s a far cry from the simplicity and usability of many other modern course builders.

There’s also support for blended learning, video courses, but the most interesting feature, in my opinion, is the ability to perform skills gap tests, then assign courses and learning paths based on your trainees’ specific skills to keep close track of their development.

Pricing

Prices start from $750 per month for up to 1000 registered users – Billed annually.

Goodies I found

- Enterprise-grade security compliance

- Accessibility requirements

- Fully compliant with the WCAG-2, Section 508, and ADA accessibility requirements.

- Skill management

- Integrations via Zapier

My final opinion

A good LMS that is particularly suited to organizations that are looking for deep source code-level customization options, and have multi-region data compliance obligations. However, it will not be the best choice for those who want to create courses right on the platform since it has a course builder that can be a struggle for non-instructional designers. It may also require you to hire tech specialists for managing the LMS.

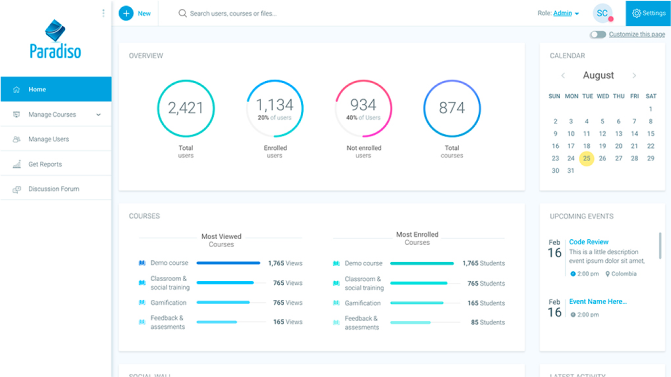

3. Paradiso

Learn moreRating: 4.2/5 from 10 reviews (Capterra)

Paradiso is a combined LMS and e-learning platform that focuses on delivering four pillars – Utility, Price, Maintenance and Mobile Compatibility.

Deep dive

Paradiso has great potential to create different kinds of e-learning content. To author courses without any coding, there’s the browser-based Paradiso composer. This allows you to build HTML5 based courses that can be accessed using any device. Paradiso also has a built-in tool for creating immersive interactive videos. Authored courses and videos can be packaged as blended learning solutions that incorporate video conferencing.

There’s also support for knowledge sharing via document repositories, blogs, wiki pages, social networking, chat rooms, video channels, and discussion forums.

In terms of performance management, you can do appraisals, competency-based learning, performance reviews, and Individual Development Plans (IDP) and link these to content and learning programs.

Aside from all the features reviewed, Paradiso boasts a SCORM and AICC compliant course library that has 5000+ on-demand employee training videos. They cover business training topics such as communication skills, leadership and management, sales and customer service, compliance training, and anti-harassment, amongst others.

Pricing

No price listed by vendor, must contact for a quote.

Goodies I found

- Built-in tools for course and interactive video authoring

- Multi-channel knowledge share options

- Rich course library

- Plentiful LMS integrations

My final opinion

This LMS may be of interest to financial institutions wishing to supplement custom industry training with more standard soft-skills modules from the existing library to reduce the cost of building learning pathways.

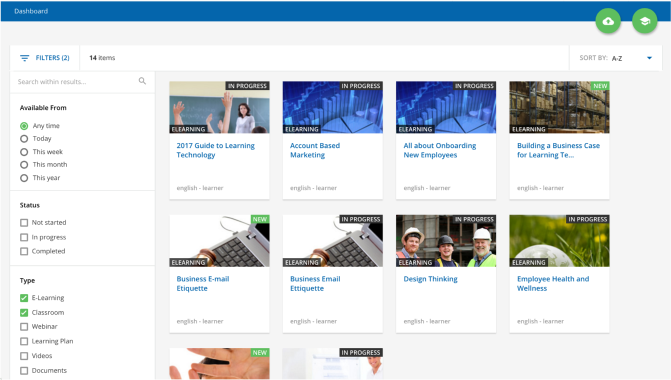

4. Docebo

Learn moreRating: 4.2/5 from 123 reviews (Capterra)

Docebo is a customizable LMS platform that offers a wealth of configuration options. You can set up various training programs that include not only formal but also informal training. All of this can be done in a virtual collaborative environment.

Deep dive

Docebo employs a modular system, which may be unfamiliar if you have experienced more traditional LMS platforms. The core module, Docebo Learn, provides all the basic LMS options, including course management, user management, and tracking and reporting, but is not intended to cover every training base.

Some other modules that support other functions and are available on a separate pricing scale are:

- Discover, Coach & Share. An informal learning module that allows learners to share their knowledge among themselves and interact with subject matter experts. This is powered by Artificial Intelligence (AI) that makes it easier to upload content and share it, as well as deepening search capabilities.

- Extended Enterprise. A module designed for training external users. You may need it if you’re going to train somebody beyond the walls of your financial organization, like partners or customers.

Docebo is an LMS product with which courses can be created as e-learning and combined with courses from a variety of third-party providers. Like Paradiso, it provides access to a rich learning library, covering topics from compliance to soft skills. However, access to this catalog is available for an additional fee.

Pricing

No price listed by vendor, must contact for a quote.

Goodies I found

- Modular system

- Ample opportunities for informal learning

- Advanced content management with AI technology

- A rich course library

My final opinion

Best suited for organizations that prefer a modular approach to the L&D infrastructure and perhaps have an eye on future scalability whilst keeping initial implementation costs down. It’s also a good choice for those who already use the add-on course libraries, e.g., LinkedIn training. The only disadvantage is that a lot of the desirable features are only available for an extra fee.

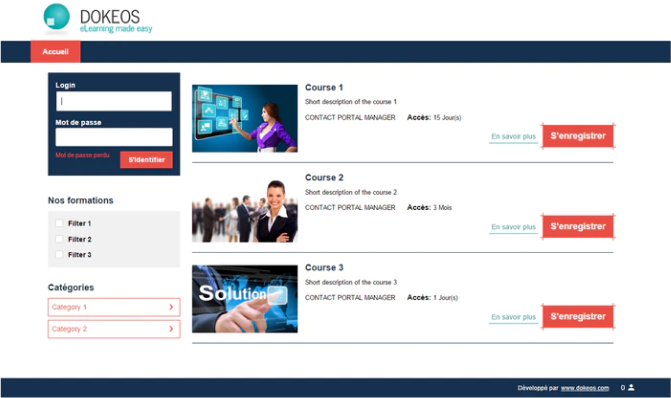

5. Dokeos

Learn moreRating: 4.4/5 from 12 reviews (Capterra)

Type of solution

Dokeos is somewhat unique in our line up today, as it was designed as a privacy and compliance LMS. So it’s well suited for bank e-learning. In addition to standard LMS features, Dokeos offers out-of-the-box support for regulatory, audit, and compliance requirements.

Deep dive

To create training content in Dokeos, you can integrate an array of outside platforms covering e-learning authoring tools, presentation software, screencasting tools, and animation platforms. This means you can choose the most suitable tools for each project. The standard Dokeos output format is HTML5, so any training will be accessible from all devices, and SCORM reporting can be analyzed directly from Dokeos.

There’s support for collaborative features, such as contextualized chats, that can be attached to training activities and peer-to-peer knowledge sharing via chat.

There are plenty of assessment options to help create evaluation tests and knowledge checks with the built-in quiz editor. Once learners pass a course or module, their certification can be supported by electronic signature verification, which is perfect for banking regulatory training.

Administrative processes are automated and compliant with your chosen industry regulations, including FDA and HIPAA compliance.

In a banking use case, when an audit occurs, you must be able to easily print the individual monitoring charts and proof of their validity from your LMS. Dokeos supports this and more, including:

- Individual monitoring charts

- Traceability logs

- SLA Banking to ensure the privacy of your data and LMS interoperability with your SIRH.

Pricing

From $0.05 per user/month – pricing only available on request

Pros

- Regulatory compliance with financial industry standards

- Certification supported by electronic signature verification

- Knowledge sharing via collaborative chats

- A built-in quiz editor

My final opinion

A great choice for organizations with additional or custom audit, reporting, and compliance requirements.

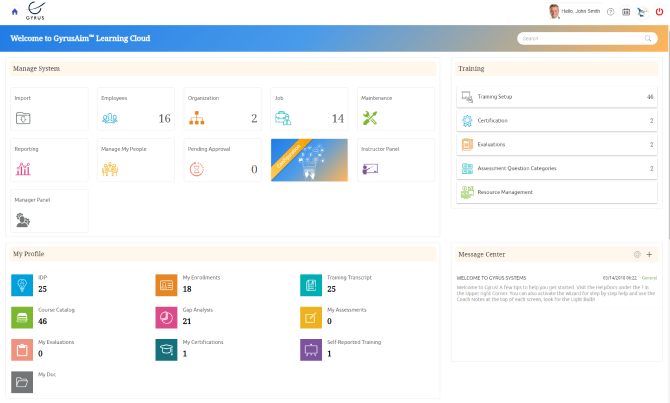

6. Gyrus

Learn moreRating: 4.8/5 from 10 reviews (Capterra)

Gyrus is a cloud-based training management system that gives you a full platform to manage all of your training efforts, including e-learning, Instructor-Led Training (ILT) – in classrooms and via webinars, assessments, and certifications in a scalable and cost-effective solution.

Deep dive

Gyrus is a comprehensive system that aims to cover all of your training bases and be customizable while doing so.

The main point of difference I noticed with Gyrus is that there’s no built-in authoring tool. Rather, it is expected that you will buy content, provide your own, or add the Gyrus recommended authoring tool as additional options with your price plan. What this boils down to is that if you want to author courses ‘in-platform’ then you will have to license and use Domiknow.

This limiting factor may be off-putting given the price. You can, however, import most types of content from your own authoring tools, with support for SCORM, AICC, and Tin Can/xAPI compliant content. The LMS partners with leading providers for online courses like OpenSesame and Vado, so you can buy and upload your courses right to the platform from the content catalogs they offer.

Gyrus focuses significantly on compliance, which is good news if you choose this as your banking LMS. Compliance and reporting are designed to meet EPA, OSHA, FDA, Joint Commission, Corporate Compliance, ICD-10, and HIPAA.

Pricing

Starts at $300pm for up to 100 users.

Goodies I found

- Integration with course libraries

- 21 CFR Part 11 Compliant

- 24×7 Live support

My final opinion

With Gyrus, there’s definitely a focus on the holistic approach to training rather than just e-learning, so if your organization is big in blended solutions, webinars, and using various types of content to map to competency and skills-based programs, this platform would make a good choice.

Wrap Up

The success of companies in the financial industry greatly depends on their employees’ skills. For this reason, personnel need to know the products and services inside out. Employee training helps banks and other financial organizations standardize the knowledge about an offer, get employees compliant with the standards and regulations, and improve the quality of customer service.

With an LMS, you can achieve the best results and do this much faster than if you trained your employees face to face. I hope my article will help you when it comes time to decide on an LMS for your bank or financial institution.

Do you currently use any of the platforms I have looked at today? If so, I’d love to hear your thoughts and opinions in the comment section.

nice post.

Thank you!

Hi

Looking for an aml elearning solution to cover US/EU and UK regulations for a Financial Services company.

Best

Pat Patterson

Hello Pat! Try Kaplan Compliance Solutions, Thomson, ReutersSAI, GlobalNavex, GlobalSkillsoft.Maybe this is what you are looking for.